With the advancement of technology, mobile applications have made banking more secure and modern. These apps are very intuitive and easy to use as compared to the earlier versions. Today, those who do not have experience operating a technical device can also make a transaction by using a mobile app.

Mobile apps have changed the banking sector. Today, to do your banking, you don’t have to stand in long lines and fill out deposit slips for cash withdrawals, etc. The person can simply do banking via computer, laptop, or smartphone. With banking apps, you can check your account statement, pay utility bills, and also transfer funds, etc. In this blog, you will learn about how mobile apps are changing the banking sector.

The Benefits of Using a Mobile Banking App:

1. Enhanced Security:

As we all know, today, cybercrime is a serious concern, but banks use mobile app development and provide high levels of protection to their customers. These mobile banking apps have additional hardware security features. For safety purposes, they provide several security measures like biometric authentication methods, etc.

2. Improved customer experience:

With a well-designed mobile banking application, customers will get a better experience. These applications help the customer access their bank from anywhere. The mobile banking applications provide more benefit to the user. Applications that use machine learning (ML) provide users with tailored insights according to their interests. These banking apps provide data based on predictions made by an ML model.

3. Improved interaction with the bank:

Mobile apps are the best tool for customer and bank communication. Alert notifications strengthen the consumer’s relationship with brands if they are properly used. Banks also provide important information to the customer through this notification. Customers prefer to read the notification instead of a lengthy letter or email.

4. Reduce bank operational costs.

Mobile banking apps reduce the operational cost of the bank. The customer doesn’t have to carry papers thanks to the mobile apps, which saves time, money, and resources for the bank as well as the customer. Additionally, this will also reduce the operating and maintenance costs of branches. Lastly, the transactions that are made through mobile apps are more affordable than those made through ATMs.

5. The power of mobile analytics

Financial institutions get a wide range of data through these mobile banking apps, which is also useful for gaining valuable client feedback. These apps give a clear understanding of customer preferences and wants, which is valuable information for product development. The information that is acquired through mobile app development services can enhance the consumer experience.

Features of Mobile Banking Apps

1. Cashless Payment

With mobile app development services, there has been an increase in digital payments, which has pushed the banking industry’s ability to assist customers to new heights. Not only this, but by using apps, users can make peer-to-peer payments, through which they can send and receive money directly.

2. Voice Payments

Voice search has become one of the most important emerging technologies in our lives. Your smartphones and linked devices can be instructed verbally to perform any task. Voice banking is slowly but surely making its way into the banking industry and providing lots of benefits to the customer.

3. Sign-In with Confidence:

For all mobile apps, security is the topmost priority. Although multi-factor authentication is a secure technology, many users find it annoying, according to biometric data-based authentication. To identify a person, biometric authentication technology looks at the body’s characteristics. It involves hearing a user’s voice, typing rhythm, etc.

4. Chatbot

Banking relies on communication, and with the help of chatbots, customers get immediate answers to their questions. Every company wants to give a benefit to the customer. It is essential for banks to provide help, expert consultation, or advice to their clients around the clock. Hence, banks use AI chatbots to assist their customers. They can serve hundreds of customers by using an intelligent chatbot without making them wait for long. Chatbots are available for the customer 24/7.

Fintech: The Future of Financial Service

Fintech takes a special place in the technology world, and it is used to enhance financial services. As smartphones are widely used, this technology is now accessible and affordable. This has helped to accelerate the tremendous rise of financial technology.

In the beginning, technology was only used for bookkeeping and accounting in the back offices of banks. But now, this technology is used largely for personal and business finance.

Fintech is the future of financial services, as it now includes a wide range of financial activities such as instant money transfers, QR code-based payments from smart phones, avoiding banks to apply for loans, and also making investments without the help of a person.

Related Posts

Software Development Team: Key Roles & Structure

In today's digital era, every business needs a software development team to create and maintain their digital products and services.…

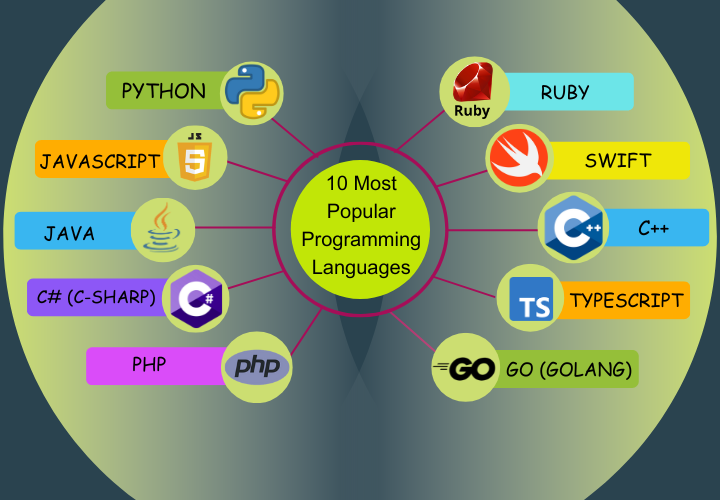

A Beginner’s Guide to the 10 Most Popular Programming Languages

Within the ever-evolving realm of technology, programming languages are essential in determining the digital terrain. Selecting the appropriate programming language…